If you counsel older adults on benefits programs like Medicare Part D Extra Help or the Medicare Savings Programs (MSPs), you've likely come across asset limits when determining eligibility.

What is an asset test?

An asset test is a limit, or a set maximum amount of assets (sometimes called resources) a Medicare enrollee can have and still be eligible for a specific subsidy program (e.g., the Medicare Savings Programs).

Assets include:

- Savings and checking accounts

- Stocks and bonds

- Retirement accounts

- Real estate

- Mutual funds

Some states have no asset test. But in states that do, certain resources will not be counted as assets, including money in a pre-paid burial expenses fund or money set aside in a designated account for burial costs. This is known as the “burial disregard.”

How do I count the burial disregard in Medicare?

Below, we explain how counselors count the burial disregard in considering eligibility for the Part D Extra Help (Low Income Subsidy/LIS) benefit and Medicare Savings Programs (MSPs).

Differences in treatment of the burial disregard

While states allow up to a $1,500 burial disregard for MSPs, some apply this disregard in a more restrictive manner than others. For instance, state Medicaid offices may disregard the burial amount only if the enrollee has a separate account or trust set up for burial funds. Additionally, the state may require documentation of the separate account.

But starting April 1, 2026, state Medicaid agencies must accept an MSP applicant's attestation of hte value of burial funds without requiring documentation upfront. After enrollment, state may (but are not required to) collect additional documentation to verify what the enrollee attested to in their application. This rule was created to reduce the "red tape" of enrolling in MSPs, making it easier for older adults to get the benefits they're entitled to.

With the federal Part D LIS/Extra Help application, applicants self-report their intention to spend assets for burial purposes in question #5: “Will some money from the sources listed in question 4 be used to pay for funeral or burial expenses?” If the person answers “yes,” they receive the $1,500 per person asset disregard (most answer “yes”). If the person answers “no,” the $1,500 asset disregard will not apply.

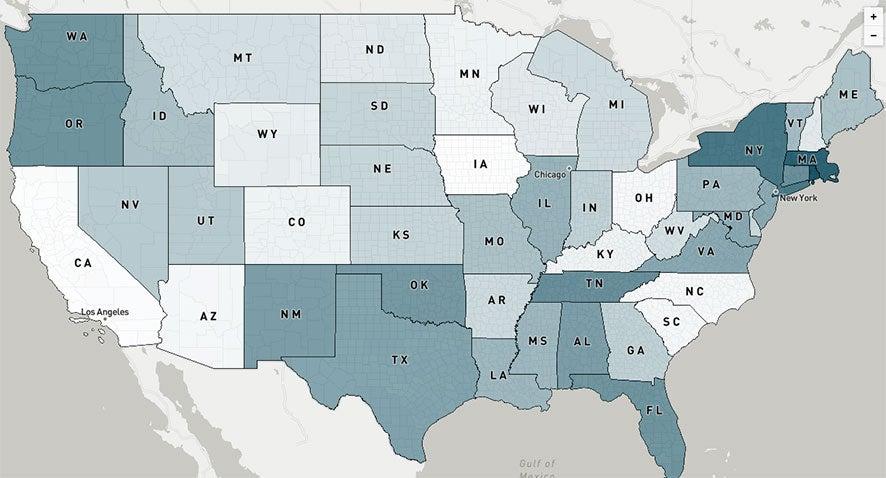

This minimum asset test applies to all MSPs (QMB, SLMB, QI) except the Qualified Disabled Working Individual (QDWI) program. Some states have higher MSP asset limits—and some have no MSP asset limits at all. Enrollees should contact their local Medicaid office or State Health Insurance Assistance Program (SHIP) to learn more about MSPs in their state.