Related Topics

Regardless of your age, income, or comfort level with money and debt management, creating and using a budget is one of the most important things you can do to maintain financial security. This is true whether you rely on a budget calendar or the envelope system, are planning for retirement or thinking about extending your working years.

And once you’ve committed to a budget, knowing how to bank effectively can help you better protect and manage the money you have. That’s where online banking comes in. Most financial institutions offer online banking for their customers, and many people rely on it for their everyday money management needs.

If you currently don’t use an online banking app (or your web browser) to manage your finances, you likely have questions about it, including: How can I budget my money with online banking? Is my money safe? Is this the right tool for me? Here's what you need to know.

What is online banking?

Online banking lets you access your money using a computer, tablet (like an iPad or Chromebook), or smart phone. Instead of physically going to your local branch, you visit a secure website or mobile app to conduct your transactions.

Banking online is like using a teller, only you do it remotely. You go to the “window”—in this case, your device—and deposit checks, make withdrawals, pay bills, and more, all from the comfort of home.

How can I benefit from online banking?

Online banking offers plenty of advantages:

- It’s convenient. With online banking, you don’t have to wait until your local branch is open. You can access your accounts at any time, on any day, from anywhere that you have an internet connection—even when you’re traveling.

- It’s nearby. You don’t need to drive, rely on other transportation, or worry about navigating in bad weather to get to the bank. With online banking, simply turn on your computer or unlock your smart phone and you’re ready to conduct transactions.

- It’s accessible. Although not true in every case, your bank’s website may include assistive technologies, such as screen readers and voice command capabilities, that make online banking easier if you live with vision or hearing loss.

- It’s automatic. Most banks and credit unions offer this service, so you don’t have to switch financial institutions in order to take advantage of online banking. And you won’t need to ask special permission, either. If available, online banking comes with the accounts you already have. You’ll just need to set up your login and password to get started—both of which you can do from your bank’s website. (See “I’m Ready to Try Online Banking,” below, for tips on creating a strong password.).

- It’s safe. You’ve probably heard stories of thieves stealing physical checks from the mail, changing their amounts, and cashing them. Although banks typically bear the burden for such crime, and most victims eventually get their money back, the disruption and stress it causes is very real. With online banking, you can avoid this risk altogether. Because all transactions are paperless—including any bills you pay—no one can steal your checks or copy down your account information from one. Instead, your bank uses a secure method, called encryption, to send and receive money on your behalf. And another thing: though it’s unlikely you carry around large sums of cash, you won’t have to worry about someone stealing your wallet or purse on your way to and from the bank.

How does online banking help with budgeting?

If you’re used to using a check register to balance your accounts, you may be skeptical about switching to an unfamiliar system. That’s understandable, says Jessica Johnston, Senior Director, Center for Economic Well-Being at NCOA. “At the same time, you may be missing out on a powerful tool—one that can give you immediate insights into and control over your spending and savings.”

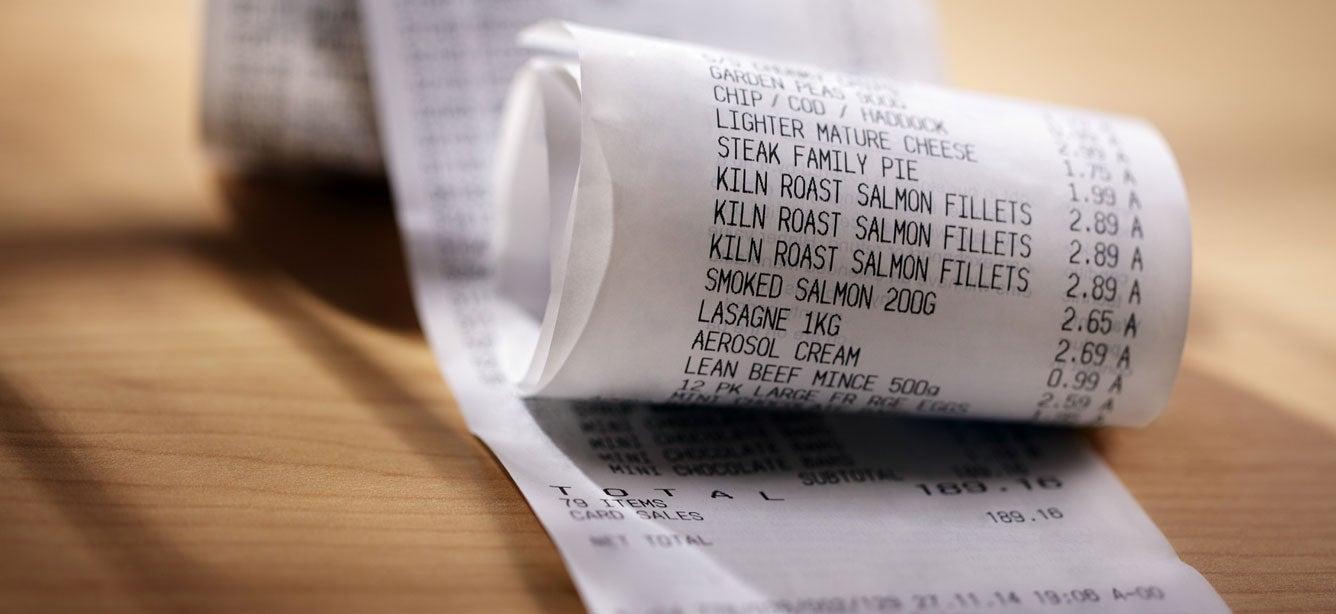

For example, you can always check your deposits, debits, and transfers in real time with online banking. No more waiting for a paper statement to arrive in the mail! You won’t forget to record a transaction in your register, either—or make an addition or subtraction mistake, which are common when doing the math by hand. This can help you avoid unintentional overdrafts and the fees that go with it.

Here are some other ways that online banking can help with budgeting:

- You can organize transactions and run reports. When you use online banking, you can set up and assign categories for your income and expenses. For example, you can group deposits under “Social Security,” “pension benefits,” or “life insurance payments;” and purchases under “entertainment,” “housing,” “utilities,” or “gifts.” By matching your categories to the line items in your budget, you can gain real-time visibility into your spending, quickly identify problem areas, and make necessary adjustments.

- You can set up automatic payments. With online banking, you never have to miss a due date. You can schedule all of your recurring bills for payment from a specific account on a day that you choose. This is true even if the amount you owe changes every month.

- You can see exactly what your balance is. Have you ever worried that a check you wrote might bounce? Fears like these are common among people who rely on their checkbook registers to keep tabs on their money. Even if you’re a stickler for writing down every transaction, the system isn’t foolproof. Sometimes, for example, there are gaps between when your deposits clear and when the checks you’ve sent get cashed. And you can’t truly reconcile the amount in your register with your actual account balance until your paper statement arrives in the mail. It can be reassuring to know exactly how much you have in your checking and savings accounts at any given time—and online banking provides that reassurance. No more guessing whether you have enough funds to cover your bills.

- You can easily transfer money between accounts. This is especially useful when it comes to achieving your savings goals. Budgeting for savings, and making it happen, are two different things—and it’s much easier to put money aside when you can do it with the click of a mouse or tap of a finger. Plus, it’s less tempting to spend that money when you put it into its own separate account.

I’m ready to try online banking. Is there anything I should watch out for?

Absolutely, said NCOA's Johnston. First, know that banks have an active stake in preventing fraud, such as identity theft and unauthorized use of your accounts and credit cardss.

As a result, banks proactively anticipate and prepare for a variety of threats—and build state-of-the-art security measures directly into their online systems to protect against them,” Johnston said.

Still, online banking security is a shared responsibility. These tips can help keep your money safe:

Create a strong password

These days, you need a password for almost every activity on the internet: shopping online; accessing your medical records; watching movies on your favorite streaming channel; even reading newspaper articles through a paid subscription. And it can be hard to manage different passwords for all of these options.

If you’re tempted to use the same password for online banking that you use for something else, don’t, warned Johnston. Weak passwords, and password re-use, invite hackers to get into your accounts.

Safeguard your money by using our easy-to-follow guide on creating and using strong passwords.

Beware of scams

Financial scams targeting older adults are on the rise, and any one of us is at risk—regardless of our income and resources.

That’s the bad news. The very good news is that knowledge is power. Learn about the five most common techniques scammers use to gain access to your money, and what steps you can take to protect yourself against phishing and other online fraud.

Regularly check your transactions and balances

Every financial institution uses sophisticated methods to uncover unusual activity on your accounts. In many cases, your bank will even notify you of suspected fraud and block access to your money long before you know something is wrong. But it’s always a good idea to monitor your checking and savings accounts personally.

How often should you check your online banking accounts? This is really a matter of preference, although logging in once a week is generally a good rule of thumb, Johnston advised.