Related Topics

Saving money isn’t the easiest thing to do these days. This is even more true for those of us who live on fixed or limited incomes.

Costs continue to rise, but our paychecks stay the same. How can we put extra cash in the bank when we can barely afford to cover day-to-day living expenses?

“First, know that it’s never too late to save money,” advised Jen Teague, Director for Health Coverage and Benefits at NCOA. “And you can start with small steps. It’s easy to feel overwhelmed by the idea but remember: anything you can set aside is a good thing.”

Whether you’re currently employed and trying to save for retirement—or are out of the workforce and want to build an emergency fund—you likely want to know, “How much money should I save each month?”

As always, the answer depends. But there are some general guidelines that experts recommend. Let’s take a look—and see whether any of them might work for you.

Why it’s good to save money

But first, a story.

Charles, 74 (we changed his name to protect his privacy) lives in an apartment with a monthly cost that already stretched his limited budget. When his landlord recently raised the rent, Charles grew anxious. Even after asking his children for a little extra money—something he really didn’t want to do—the math simply didn’t add up. His Social Security check left no financial cushion for unexpected life events like this. He could pay the increased rent, but wouldn’t have money for food, utilities, and other basic necessities. And what would he do next year if his landlord upped the amount again?

“Across the United States, millions of older adults like Charles find themselves in a similar situation right now,” Teague explained.

Our nation’s badly frayed safety net continues to fail people who don’t have extra money to save for retirement—and who now rely heavily on their Social Security paycheck to cover their basic living costs,” Teague said.

Fortunately, as Charles learned, there are ways to save money even when your budget is stretched thin. We’ll get to that a little further down.

Strategies to save money each month

How much money should you save?

If you like benchmarks, then it may help to know the current averages by age group, according to the most recent data published by the Federal Reserve:1

- 55–64: $57,800

- 65–74: $60,400

- 75 and over: $55,600

These figures represent dollars kept in liquid accounts including checking, savings, money market, and some prepaid debit cards.

Keep in mind, however, that they also may have little to do with your own financial reality. The very best way to answer the question, Teague said, is first to sit down and write a list of your income and non-discretionary expenses—the things you need to pay. When you do that, you know exactly what you have to work with.

Try using a simple budget calendar, which helps you see and get a handle on your finances in a straightforward way. Using your own personal bottom line as a guide, you then can see whether one or more of the following suggestions works for you.

What is the 70/30 rule?

This common guideline is easy to follow, at least in principle:

- Live on no more than 70% of your income

- Save 30% of your income

Let’s say you collect the average monthly Social Security benefit for a retired person, which is $1,976 as of January 2025. Ideally, according to the 70/30 formula, you should save around $593 each month.

“Of course, when you live on a fixed income, putting this amount of money aside can seem impossible,” said Teague. “So instead, think of this guideline as way to prioritize your budget and practice good financial habits.”

In other words, the rule still can help guide your spending decisions: Is this purchase something I need? Or is is something I want? Try personalizing the rule to fit your situation more closely. Could you make 95/5 work instead?

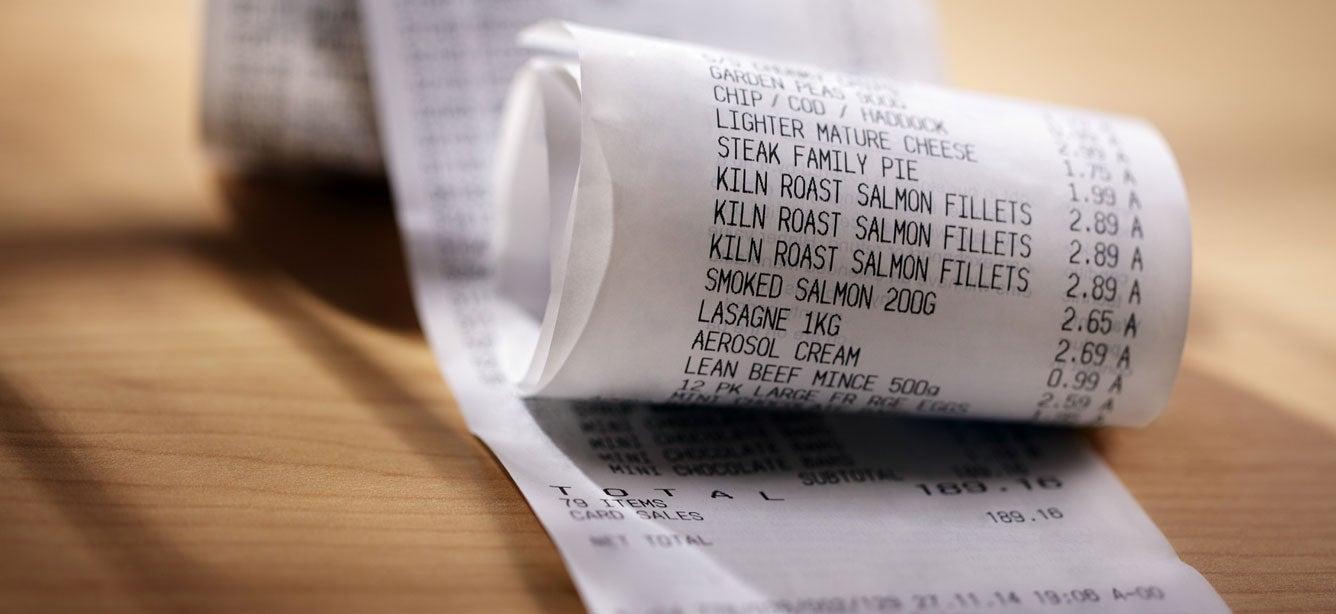

Find ways to cut non-essential costs

Can you reduce your spending at all? If your budget is tight, this can be a good way to save money. And some of these savings hide in plain sight.

For example, many cell phone providers offer service discounts for older adults. You just need to ask. Taking advantage of senior discounts can save you 5%, 10%, or even more on products and services you already buy.

Explore benefits programs that can help you save money

Millions of people miss out on saving money through public and private benefits programs simply because they don’t know about them, don’t believe they’re eligible, or aren’t sure how to apply.

That’s what Charles learned. And he’s tremendously grateful for the life-saving support he discovered, thanks to his local Benefits Enrollment Center (BEC). These community-based centers and their caring, professional staff help Medicare-eligible people—including older adults with low incomes and younger adults with disabilities—find and apply for crucial financial assistance programs.

With help from his benefits counselor, Charles signed up for SNAP (formerly known as Food Stamps), a Medicare Savings Program (MSP), and the Low-Income Home Energy Assistance Program (LIHEAP). Together, these programs will save Charles hundreds of dollars each month!

“When you qualify for and enroll in these programs, you keep more money in your pocket,” Teague said. “Consider it a different type of savings plan—one that you’ve earned and absolutely deserve.”

The bottom line

“The biggest takeaway is that the idea of saving money should make you feel empowered, not ashamed,” Teague said. “Any savings is good savings. While it may be interesting to know how much money other people have in the bank, it’s not always helpful. No two situations are the same. Try to avoid comparing yourself to an arbitrary average and instead focus on what’s reasonable for you right now.”

Browse additional money-saving benefits

Do you know about NCOA’s BenefitsCheckUp®? This free, online tool connects millions of older adults with financial assistance programs that can help pay for health care, medicine, food, utilities, and more. Visit today to explore a variety savings opportunities for you or someone you know.

Sources

1. Aditya Aladangady, et al. Changes in U.S. Family Finances from 2019 to 2022: Evidence from the Survey of Consumer Finances. Board of Governors of the Federal Reserve System. October 18, 2023. Found on the internet at https://www.federalreserve.gov/econres/scfindex.htm