Related Topics

For many older adults, becoming eligible for Medicare is something of a rite of passage—a major milestone in their life’s journey. In most cases, the minimum age for Medicare is 65. People who are younger than age 65 may also qualify in certain circumstances.

One thing you should know is that receiving Medicare benefits is not automatic for everyone. While some people will get coverage automatically, others must apply for the program. Below, we explain how to find out if you’re eligible for Medicare, whether you need to apply, and how to apply if you do.

What are the rules for applying to Medicare?

If you’re wondering, “Am I qualified for Medicare?”, the guidelines below can help you figure it out.

If you’re 65 or older, you’re eligible for full benefits if:

- You’re a U.S. citizen or permanent legal resident, and you’ve lived in the country for a minimum of five years.

- You (or your spouse) are a current or retired government employee who has paid Medicare payroll taxes while employed.

- You collect Social Security or Railroad Retirement benefits. Or you’ve worked enough years to qualify for these benefits even if you’re not receiving them.

If you’re younger than 65, you’re eligible for full Medicare benefits if:

- You have permanent kidney failure requiring dialysis or a kidney transplant and you (or your spouse) have paid Social Security taxes for a defined amount of time.

- You have amyotrophic lateral sclerosis (ALS).

- You’re collecting a disability pension from the Railroad Retirement Board (you must also meet specific conditions in addition to this).

- You’ve qualified for Social Security disability benefits (SSDI) for a period of at least 24 months.

When deciding on other Medicare options, including Medicare Advantage, Medigap and Medicare Part D, be sure you make a choice based on your personal situation.

Automatic enrollment: If you're already receiving Social Security retirement (because you chose early retirement after age 62), or you receive Social Security Disability Benefits (or Railroad Retirement benefits) when you turn 65:

- Medicare Parts A and B (original Medicare) enrollment is automatic.

- A “Welcome to Medicare” packet and Medicare card will arrive in the mail from the Social Security Administration about three months before your 65th birthday.

Must apply: Do you have to sign up for Medicare in certain situations? If you did not choose early retirement between the ages of 62 and 65, you must contact Social Security to apply. You can enroll during your Initial Enrollment Period (the three months before, the month of, and the three months after your 65th birthday). Upon enrollment, Social Security will send a "Welcome to Medicare" packet that includes your Medicare card.

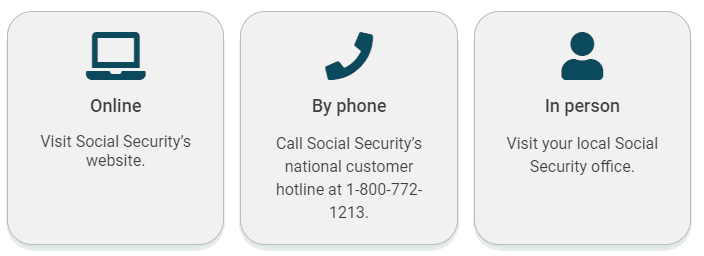

Three ways to Apply for Medicare Parts A and B

There are additional options for your health and prescription drug coverage:

- Part C, or Medicare Advantage plans: You can choose a Medicare Advantage plan in place of original Medicare. The Medicare Advantage plans include original Medicare and usually a prescription drug plan. Medicare Advantage plans are run by private health insurance companies. Are Medicare Advantage plans worth it? While some Advantage plans offer greater plan flexibility and long-term savings, some can involve additional costs. Be sure to understand the pros and cons before making a decision.

- Medigap: People who choose original Medicare (for Parts A and B coverage) often enroll in a Medigap plan to address the “gaps” in coverage. Offered by private companies that contract with Medicare, these plans help pay for out-of-pocket costs not covered by Parts A and B. Plan options are standardized across most states.

- Many people wonder, “Does Medicare pay for prescriptions?” That is where Part D comes in: People who choose original Medicare generally must also choose a Part D plan for prescription drug coverage. If you do not enroll in Part D when you are initially eligible (and you do not have other creditable drug coverage), you can face a penalty when you do enroll late.

To join an additional Medicare plan (Part C, Part D or Medigap), start by comparing local plans. Before enrolling in any of them, be prepared to provide your Medicare number and Part A and/or Part B coverage start date. This information can be found on your Medicare card.

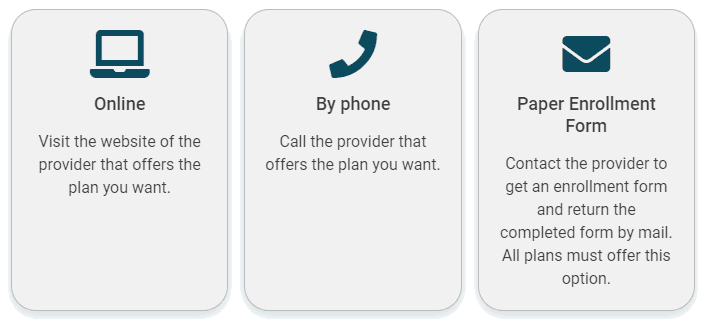

Enrollment in these plans can be done a few ways:

Three Ways to Apply for Medicare Parts C/D/Medigap

It’s important to look at your personal situation when deciding how to receive your Medicare health and prescription drug coverage. You need to consider your health status, lifestyle, out-of-pocket costs and other factors to make the best choice.

Need help choosing a Medicare plan?

Reach out to your local State Health Insurance Assistance Program (SHIP) for personalized guidance and recommendations. Their trained counselors are available to provide 1:1 assistance as you decide which coverage option(s) are right for your health needs and budget.

You can also call 1-800-MEDICARE (1-800-633-4227) to talk with a customer support representative—or visit the Medicare.gov website to start a live chat. TTY users should call 1-877-486-2048.