Related Topics

How do you feel about money?

Do you not think about it much? Or do you spend most days worrying about it?

Do you keep close track of every penny—or do you cross your fingers and hope for the best?

If you’re like most Americans, you may feel uncomfortable talking about your finances. Unfortunately, this can prevent you from getting the information and help you need to build good money and debt management skills.

Financial security as we age: A taboo topic

Consider this: A recent analysis by the National Council on Aging (NCOA) and LeadingAge LTSS Center @ UMass Boston found that 80% of Americans 60 and older continue to face financial insecurity.1

In addition, American adults have a financial literacy rate of only around 50%.2 It’s no wonder 56% of people reported feeling anxious when thinking about their financial situation.3

“So many of us were raised to believe that talking about money is taboo—even more so than discussing politics at the Thanksgiving table,” said Jessica Johnston, Senior Director for NCOA's Center for Economic Well-Being. “But that means we miss out on valuable opportunities to learn from others’ successes and mistakes—and to grow our understanding of how money management works with help from trusted family and friends.”

These missed opportunities can also be particularly harmful for older adults who live on fixed incomes.

Today’s economy means that many people are struggling to make ends meet,” Johnston continued.

“But when they suffer in silence, because they’re reluctant to talk about money, they don’t get the help or benefits they deserve,” she said.

Flora Wallace's story

Flora Wallace knows this all too well. The 74-year-old retired Chicagoan lives on her monthly Social Security check. It doesn’t stretch as far as it used to since food prices have significantly increased over the past several years. Although Wallace needs to follow a healthy diet to help manage her diabetes, she was finding it more and more difficult to buy nutritious food after paying her rent and other bills.

“When you live on a fixed income, sometimes you have the chance to buy the food you want and sometimes you don’t,” Wallace said.

Fortunately, she reached out to the Greater Chicago Food Depository, where she received help enrolling in the SNAP benefits program. Now, with this important food assistance, she finds it much easier to balance her budget.

Why should older adults budget?

Speaking of budgets—knowing how to set up and use one is perhaps one of the most important steps you can take to better control your money. And it’s never too late to get started.

“For many older adults, the path to financial stability begins with basic money management,” NCOA's Johnston said. “Learning how to budget can help them stay secure and independent longer, which is essential to aging with dignity, choice, and peace of mind.”

How do I budget?

1. Before you begin, read up on NCOA’s Top 10 Budgeting Tips for Older Adults. This handy guide will help you identify key areas where you may be able to put more money back into your pocket.

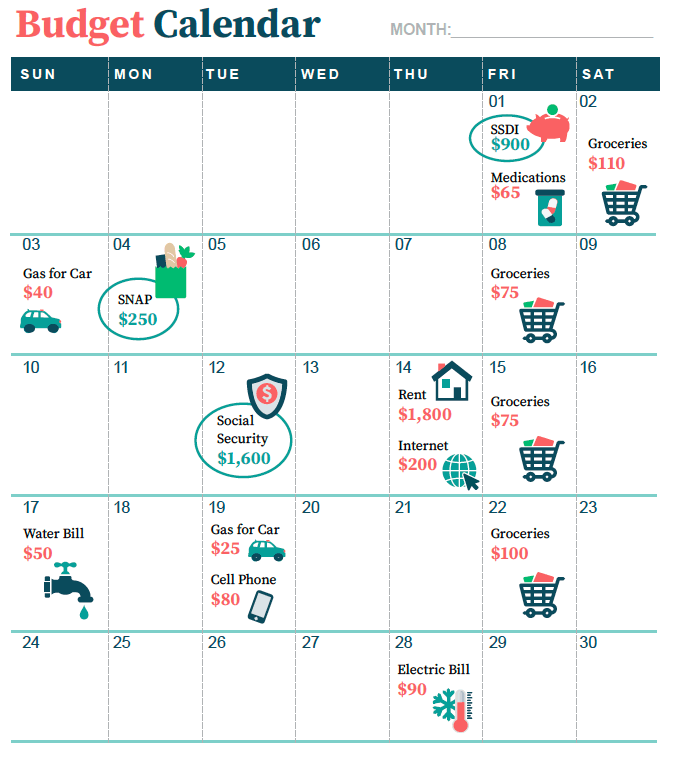

2. Consider setting up a budget calendar. If you do nothing else, this simple money management tool will provide immediate visual insight into your finances. And you don’t need a fancy computer program to do it.

3. Learn about the 70/30 rule—a common budgeting formula that can help guide your spending decisions.

- Live on no more than 70% of your income

- Save 30% of your income

“When you’re on a fixed income, saving money can seem impossible,” Johnston said. “But building up a financial safety net is crucial at any age. Sticking to this guideline creates personal accountability.”

The 70/30 rule, in other words, can help guide your spending decisions: Do I need this? Or do I want it? Even if this goal seems out of reach right now, it’s a good one to shoot for as you make budgeting a regular part of your life.

4. Boost your budget with benefits programs—which can provide crucial financial assistance. If you’re a retired worker living on the average monthly Social Security benefit of $1,978.77, you may not have much left to save at the end of the month. Fortunately, there are nearly 2,000 benefits programs that can help you pay for food, medicine, utilities, and other daily expenses.

Visit NCOA’s BenefitsCheckUp to learn more and get connected to programs in your area.

I'm ready. What do I need to do to get started?

1. Learn about the parts of a budget. These are the numbers you will plug into your monthly plan and include:

- Income: Your Social Security, Supplemental Security Income, training wages from Senior Community Service Employment Programs, or volunteer stipends.

- Monthly fixed expenses: Your mortgage or rent; medical insurance premiums; and fixed debt payments.

- Monthly flexible expenses: Your food, utilities, and gas for your car.

- Periodic expenses: Costs for your home and car insurance, repairs and maintenance, and your property taxes.

- Discretionary expenses: Your clothing and personal care purchases; entertainment; and charitable giving.

2. Identify where your income comes from. Gather up all of your pay stubs from Social Security and other government benefits, pensions, and any money you receive from life insurance plans or other sources.

3. Learn where your income goes. For one week, keep track of everything you spend your money on. Be honest! Using a spending diary like the one below can help (notice how we've already tracked expenses and income)

4. List everything on a simple budget sheet. Pull everything together in one place and voila! You have a working budget! Try creating yours today with NCOA's blank calendar (link to download at home).

The bottom line when it comes to budgeting

Of course, having a budget won’t change your money situation overnight. But it will be a powerful tool for helping you achieve toward greater financial stability. And remember, using a budget takes practice. Even if you hit some obstacles along the way, keep trying with the 70/30 rule in mind.

Sources

1. Jane Tavares, PhD et. al. The 80%: Increases in Older Americans’ Income and Household Assets Still Cannot Support Most During Financial Hardship. National Council on Aging and LeadingAge LTSS Center @UMass Boston. August 2024. Found on the internet at https://assets-us-01.kc-usercontent.com/ffacfe7d-10b6-0083-2632-604077fd4eca/108ad617-addf-4d8d-9919-5197cc08b4e9/2024_Research_80_Report.pdf

2. World Economic Forum. Can you answer these 3 questions about your finances? The majority of US adults cannot. April 24, 2024. Found on the internet at https://www.weforum.org/stories/2024/04/financial-literacy-money-education/

3. FINRA Investor Education Foundation. “Gauging the State of Financial Capability in the U.S.” Found on the internet at https://finrafoundation.org/knowledge-we-gain-share/nfcs