Related Topics

As you no doubt have noticed, soaring inflation has touched nearly every aspect of daily life since rates first began to rise around the middle of 2021. The lingering effects of our COVID-19 recession—combined with global supply-chain disruptions, ongoing war in Ukraine, and even some monetary policies—have driven consumer prices to record-breaking highs. In December 2022, for example, the Consumer Price Index (CPI) rose 6.5% over the previous 12 months.1 Although this increase was smaller than last year’s high of 9.1%, set in June, it’s still significantly greater than any other annual inflation rate during the past 20 years.

It’s no wonder that Social Security’s historic cost of living adjustment already isn’t enough. On top of everything else, the extra 8.7% in monthly benefits (about $140 on average) simply can’t make up for the skyrocketing health care and housing costs that many older adults face. This means that individuals are increasingly on the hook for bridging the gap between their incomes and the basic costs of living. And when those incomes are fixed, the challenges become even greater.

"Building up your savings to cover emergency—and even non-emergency—expenses is therefore more important now than ever," said Josh Hodges, NCOA's Chief Customer Officer. "But there’s some irony here: Because one of inflation’s glaring exceptions involves the money you keep in the bank."

According to data compiled by the Federal Deposit Insurance Corporation (FDIC), the national average annual percentage rate (APR) paid on traditional savings accounts is currently 0.33%.2 While not zero, it may as well be: unless you have significant wealth, your liquid assets aren’t generating a measurable return. (By way of comparison: in 1980, when annual inflation hit a staggering 14%3, banks raised their APR to help cushion the impact). For a variety of reasons, banks don’t need to compete for customers the way they used to back then, and as a result they really have no incentive to offer better interest rates now.

It can feel demoralizing, can’t it? But it doesn’t have to. Brushing up on your budgeting skills, tweaking your spending habits, and enrolling in financial benefits programs can empower you to build financial resiliency. NCOA’s Budget CheckUp tool includes a variety of concrete strategies you can use along the way. One of these strategies is to open a high-yield savings account.

What is a high-yield savings account? Is it better to have a high-yield savings account than a standard one? Let’s take a closer look so you can decide whether one is right for you.

How does a high-yield savings account work?

This kind of account helps you grow your money more quickly than in a standard savings account, thanks to a significantly higher interest rate. Known as the annual percentage yield (APY), this rate applies both to your deposits and to the interest you earn on them: a process known as “compounding interest.” Depending on the bank, interest accrues daily, monthly, or quarterly; the more often you earn it, the faster your balance grows, and the momentum continues from there.

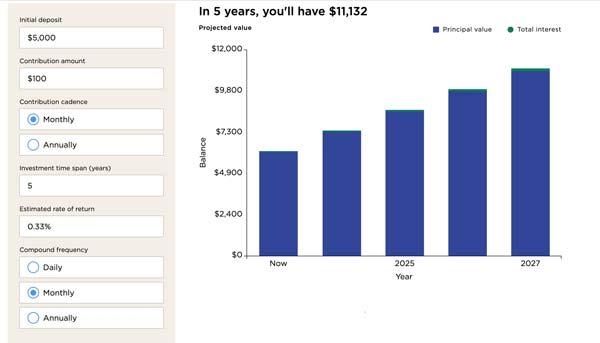

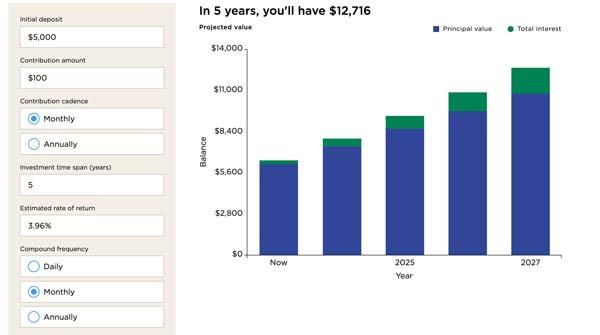

To help you visualize how this works, here are two charts comparing what could happen during the course of five years when you make the same initial $5,000 deposit to a regular savings account versus a high-yield savings account. This example also assumes that you will make an additional monthly deposit of $100 during that time period.

REGULAR SAVINGS (.33%) - 5 years of saving: $11,132

Note: Because APYs are constantly changing and will differ among banks, these charts are examples only (although the sample rates are roughly based on current APYs). And, of course, your personal situation may differ; you may have less or more to deposit initially, and less or more to contribute each month. Still, it’s easy to see how much harder your money can work for you in a high-yield account. To run through various scenarios as seen here, go to https://www.nerdwallet.com/banking/calculator/compound-interest-calculator.

HIGH-YIELD SAVINGS (3.96%) - 5 years of saving: $12,716

What are the pros of a high-yield savings account?

As of this writing, the national average APY on savings accounts is just 0.33%, according to the Federal Deposit Insurance Corporation (FDIC). That’s over 12 times less than what the highest-yield savings accounts offer.4 Additional benefits include:

- Security. Unlike money market accounts or mutual funds, these accounts aren’t speculative—so you can’t lose what you deposit. Plus, just like your regular checking and savings accounts, they’re FDIC-insured, which protects you if your bank fails.

- Flexibility. Unlike CDs, which also are well suited for short-term growth, you can access your money whenever you need to. That said, there may be limits to the number of withdrawals you’re allowed to make in a given period, so be sure to read the fine print of any depository agreement before deciding whether to open an account and at which institution. (More on this below).

- Immediacy. High-yield savings accounts are ideal for achieving your shorter-term financial goals, such as building an emergency fund—or for socking away surplus cash from accounts with lower interest rates. They allow you to maintain liquidity while maximizing risk-free growth.

What are the cons of a high-yield savings account?

- Variable rates. Interest rates on these accounts can and do fluctuate, which means the APY you started with could potentially drop. Keep your eye on such changes and remember that the money is yours; at any time, you can move it to a bank that offers a higher rate. (Also remember that, even if the APY does drop, it’s still going to be much higher than what you’d earn in a standard savings account).

- Potential penalties. The Federal Reserve sets and enforces standard rules for savings deposits. Prior to COVID-19, Regulation D limited consumers to six monthly withdrawals, after which they faced fees and other penalties, like account closure. The Fed has indefinitely relaxed this rule, but individual institutions remain free to implement it. Be sure you review all disclosures before opening any high-yield savings account. If one bank imposes transaction limits or fees, another may not—so shopping around makes sense, too.

- Limited growth. Despite high APYs and compounding interest, high-yield savings accounts generally don’t keep pace with inflation—which means they’re not ideally suited for achieving longer-term financial goals, like boosting your retirement nest egg. Investing your money with the guidance of a professional who’s bound to look out for your interests likely makes more sense in this scenario.

How do I open a high-yield savings account?

Just like you would any other bank account, with one caveat: some—though not all—high-interest savings accounts require a minimum initial deposit that you must maintain in order to earn the higher interest rate. If you dip below this minimum, your bank has the right to convert the account into standard savings or close it out completely.

Your current bank may offer a high-yield savings account, and this may be the most comfortable option for you. That said, it pays to do your homework: shop around and compare rates before deciding where to open your account. There are so many online banking options these days, and many of them pay top APY rates.

After making your choice, opening an account is straightforward. You will:

- Fill out an application. You will do this online or at your bank’s physical location if it has one. You’ll provide your name, address, contact information, and Social Security number; you will also need to show a valid license or other government-issued identification to verify your identity.

- Fund your account. Once your application is approved—which can happen quickly—you will need to make an initial deposit. You can do this with actual cash, if you’re banking in person, or by electronically transferring money from one account to another. This option is also available if your high-yield savings account is with a different bank. If you’re not sure how to do this, a customer service representative should be able to assist.

And that’s it! Now it’s time to watch your savings grow.

Sources

1. 12-month percentage change, Consumer Price Index, selected categories, U.S. Bureau of Labor Statistics. Found on the internet at https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

2. Bankers Resource Center, National Rates and Rate Caps (Revised Rule Feb. 21, 2023), Federal Deposit Insurance Corporation. Found on the internet at https://www.fdic.gov/resources/bankers/national-rates/index.html

3. The Great Inflation, 1965-1982, Federal Deposit Insurance Corporation. Found on the internet at https://www.federalreservehistory.org/essays/great-inflation

4. Earn more than 4% interest on your money: The best high-yield savings accounts of February 2023, CNBC. Found on the internet at https://www.cnbc.com/select/best-high-yield-savings-accounts/