What is the average monthly cost for Medicare? What are the 2026 Medicare premiums? While Medicare can be a vital part of managing your health care needs, it’s not free—and it doesn’t cover everything. Understanding your Medicare costs can help you make an informed decision when choosing a plan.

How much is Medicare Part A and B? Generally, there is no premium for Medicare Part A if you’ve worked 10 or more years and paid into Social Security. In most cases, you will pay a monthly premium for Part B. There are other out-of-pocket costs associated with Medicare Part A and Part B as well.

What are the costs for Medicare Part B?

For Medicare Part B in 2026, most beneficiaries will pay $202.90/month in premiums. However, there are two scenarios in which you may pay less or more than this amount:

1. If your Social Security check will not increase enough to cover the $202.90 premium, you may be subject to the "hold harmless provision." This means that under federal law:

- Part B premiums cannot increase in years when there is no Social Security cost of living adjustment (COLA), and

- the net Social Security benefit cannot be lower than the previous year’s benefit amount.

In 2026, the COLA will be 2.8%.

2. If you have a higher income, you may pay more for your Part B premiums. The surcharge is based on something called an income-related monthly adjustment amount, or IRMAA. The Social Security Administration (SSA) determines who pays an IRMAA based on income reported two years prior. In 2026, IRMAA applies to people whose modified adjusted gross income on their 2024 tax returns was more than $109,000 per individual or $218,000 for a couple. Medicare beneficiaries whose income exceeded these amounts will pay a Part B premium ranging from $284.10 to $689.90, depending on their exact income.

Is there a deductible for Medicare Part B?

The deductible refers to the amount you must pay before Medicare begins to pay its share. Before Medicare starts covering the costs of your care, you will pay an annual deductible. In 2026, the Part B deductible is $283.

After the deductible has been paid, Medicare pays most (generally 80%) of the approved cost of care for services under Part B while you pay the remaining cost (typically 20%) for services such as doctor visits, outpatient therapy, and durable medical equipment. Medicare has strict rules about what durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) are covered.

What are the out-of-pocket costs for Medicare Part B in 2026?

| Part B Premium | $202.90 monthly for most people |

|---|---|

| Part B Deductible | $283 annually |

| Part B Coinsurance | 20% of service costs, deductible must be paid first |

| Preventative Benefits | There are some services under Part B that Medicare covers at 100%, such as certain preventive benefits. See Medicare.gov for more information on these services. |

What does 'accepting assignment' mean?

Doctors or other providers who accept assignment agree to accept the amount that Medicare will pay for a visit or service (called the Medicare-approved amount) as payment in full. This helps to reduce out-of-pocket costs.

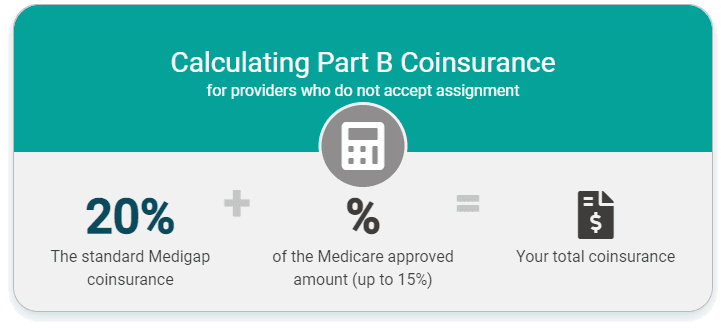

Providers who see Medicare beneficiaries but do not accept assignments can charge up to 15% more than the Medicare-approved amount. Out-of-pocket costs could be the standard 20% coinsurance—plus up to an extra 15%.

For example, if the Medicare-approved amount for a doctor visit was $100, but a doctor did not accept the assignment, they could charge up to $115 for the visit. Out-of-pocket costs could be $35 (20% of the $100 Medicare-approved amount, plus the extra $15 not covered by Medicare).

What are the costs for Medicare Part A?

Part A is often called hospital insurance because it pays for care while you’re admitted at the hospital. It also pays some costs outside a hospital, such as skilled nursing facility stays, home healthcare, and hospice care.

Most Medicare recipients (99%) do not owe a monthly premium for Medicare Part A because they (or their spouse) paid it while working for a minimum of about 10 years. This is often called “premium-free Part A.” If you or your spouse did not work for long enough, you can buy Part A (“premium Part A”). If you have premium Part A in 2026, you’ll owe either the full premium or a prorated amount.

What will I pay for monthly Part A premiums in 2026?

| Time Worked* | Premium Cost |

|---|---|

| For 10 or more years | $0 |

| Between 7.5 and 10 years | $311 |

| For fewer than 7.5 years | $565 |

*If you or your spouse worked and paid into Social Security

Is there a deductible for Medicare Part A?

In 2026, the Part A deductible for an inpatient hospital stay is $1,736. This deductible is not an annual one; it applies for each benefit period. A benefit period begins at hospital admission and ends when you’ve been out of the hospital or skilled nursing facility (SNF) for 60 consecutive days. As a result, you may have multiple benefit periods requiring payment of the Part A deductible multiple times in a year.

What will I pay for a hospital stay in 2026?

| Length of Stay | What You Pay |

|---|---|

| Days 1-60 | $0 |

| Days 61-90 | $434 per day |

| Days 91-150* | $868 per day |

*These are called "lifetime reserve days" because Medicare will only pay for these extra days once in your lifetime.

What will I pay for a skilled nursing facility stay in 2025?

| Length of Stay | What You Pay |

|---|---|

| Days 1-20 | $0 |

| Days 21-100 | $217 per day |

| After 100 days | All costs |

Hospice care

There is no deductible or copayment for hospice care, only minimal costs for medications and inpatient respite care.

Home health care

There is no deductible or copayment for home health care, as long as the beneficiary meets the eligibility criteria for coverage.

Can a provider "opt out" of Medicare?

Providers can also “opt out” of the Medicare program. That means that they can charge any amount for a service and will not bill Medicare. If a provider has opted out of Medicare, the full costs of the service must be paid out-of-pocket; Medicare will not cover any of the costs. Providers that opt out of Medicare should have signed contracts from beneficiaries stating they consent to pay the full cost of services.

Have questions about your current Medicare plan?

Is it hard to switch Medicare plans? Which company has the best Medicare Advantage plan for seniors? If you have questions about your Medicare coverage, help is available:

- Get local support through your State Health Insurance Assistance Program (SHIP): SHIPs offer free and unbiased insurance counseling and assistance to Medicare-eligible older adults, their families, and caregivers. Visit the SHIP website to learn more.

- Contact Medicare directly: Call 1-800-MEDICARE (1-800-633-4227) to speak with a customer support representative. TTY users can call 1-877-486-2048. Prefer online support? Visit Medicare.gov to start a live chat.