Related Topics

By now, it's no secret: inflation has hit the grocery aisle.

“Unfortunately, there’s no sign that’s changing any time soon,” said NCOA’s Jessica Johnston, Senior Director, Center for Economic Well-Being. In fact, the USDA predicts that food prices will rise by 3.5% in 20251—an increase that likely will exceed wage growth once again.

If you’re concerned about rising food costs and how they affect your daily expenses, a monthly budget calendar can help.

In this article, you will:

- Learn how this simple money-management tool enables you to predict and plan your cash flow

- See how to create a budget calendar for your household

- Get more information about Supplemental Nutrition Assistance Program (SNAP) and other food assistance benefits that can help you stretch your budget dollars.

Why should seniors create a budget?

There are many reasons why tracking your finances is important, no matter your age or income bracket. However, when you live on a fixed or limited income—as many older adults do—your expenses can unexpectedly escalate while your ability to pay for them stays the same.

Take food, for instance.

Combined with inflation across the board, the Washington Post reported, these rising food costs are straining household wallets across the country—with older adults bearing the brunt.2 “I’m scraping the bottom of the barrel,” says one man quoted in the article. “I do most of my food shopping in markdown bins and don’t buy much else.”

If you relate to this dilemma, you most certainly are not alone.

UMass Boston’s Elder Index measures the income that seniors need to live independently. According to its interactive modeling tool, an older adult in excellent health who lives in the Washington, D.C., area and pays a mortgage needs $3,962 per month to cover basic living expenses.3 This includes a $324 allowance for groceries.

Now, consider that the average monthly Social Security check was $1,927 at the end of 2024.4

“Even with other sources of income, it’s easy to see how many older adults are forced to walk a very thin line between spending less than they take in,” Johnston said.

Setting up and keeping a budget both can help them weather today’s uncertainties a little better—like when food prices rise—and stretch the dollars they have,” Johnston said.

How does a budget calendar help?

While planning and keeping a monthly budget calendar won’t protect against every surprise, there’s still very good news: doing so helps you get a handle on your finances in a straightforward, easy-to-visualize way. When you can see exactly what your income will be in a given month—and precisely when it will hit your bank account—you can:

- Plan your expenditures

- Pay your bills on time

- Head off any deficits

- Get in the habit of saving

- Make spending adjustments

Let’s say you’re that older adult in Washington, D.C., and you receive the maximum monthly SNAP benefit allotment of $292. Let’s also say you shop once per week and follow a pretty consistent grocery list. If you usually spend $65 each week but your cart suddenly rings up at $100, writing it down on your budget calendar will give you a very clear sense of how that increase will impact the rest of your monthly cash flow. Then you can make spending decisions based on that information.

“The extra expense of my prescription medications really hurt my budget,” Ms. G., 76, recently told NCOA.

Thanks to SNAP assistance, I now have help buying my groceries."

Can you afford to spend $400 on food? If not, can you re-allocate money from another category to put toward your groceries? What other strategies could you use to stretch the food dollars you have?

How do you create a budget calendar?

Using a calendar for budgeting is easy. You don’t need Microsoft Excel or other computer software (unless you want to do it this way), and you won’t have to consult an accountant for advice.

Here’s what you will need:

- A calendar: You can use a desk or wall calendar you already have or find a free budget calendar template you can print or use online. (You can even draw one out on paper).

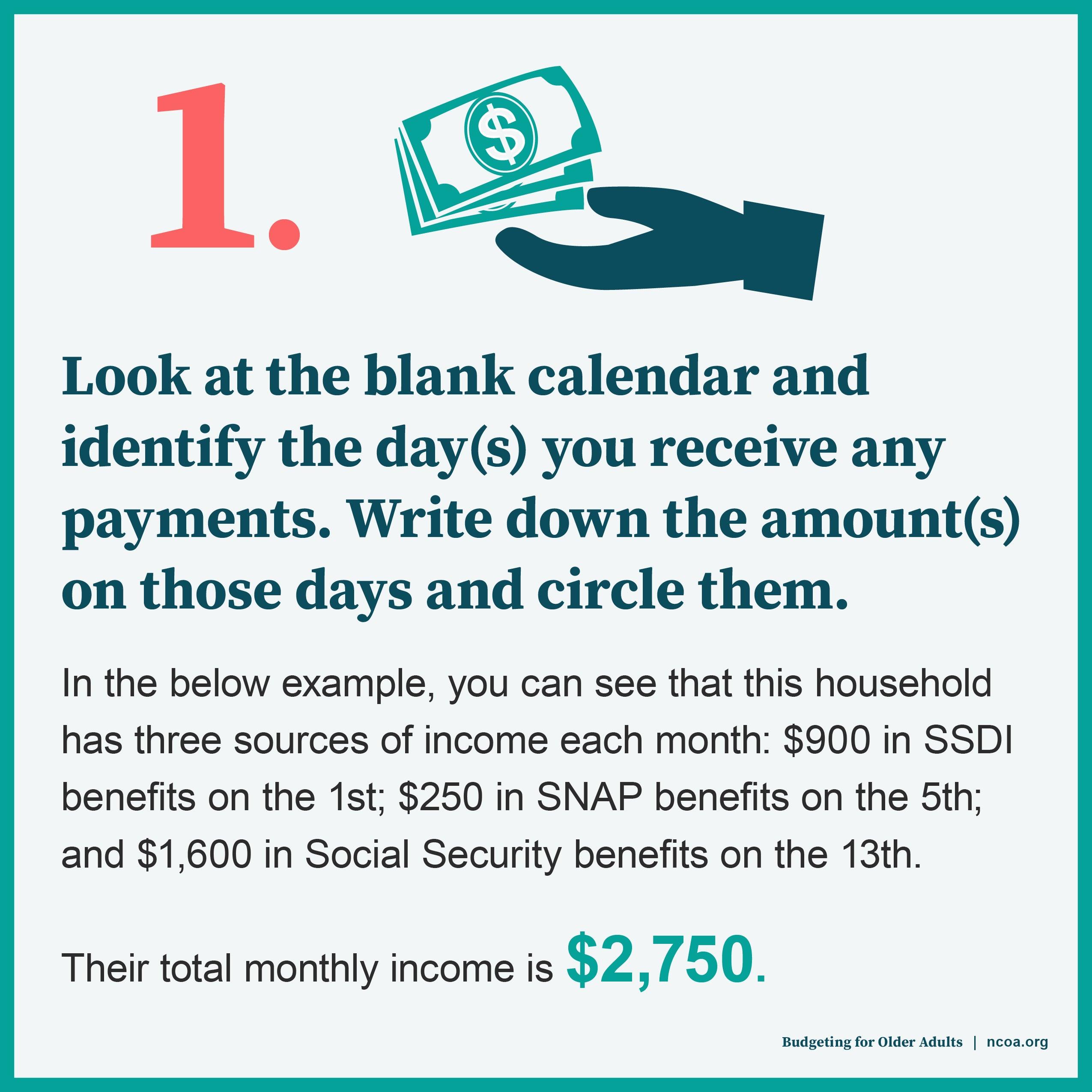

- Your income: Make a list of all the income you receive each month and when. This could include Social Security checks; income from pensions or retirement accounts; and disability benefits or SNAP payments (if you get these).

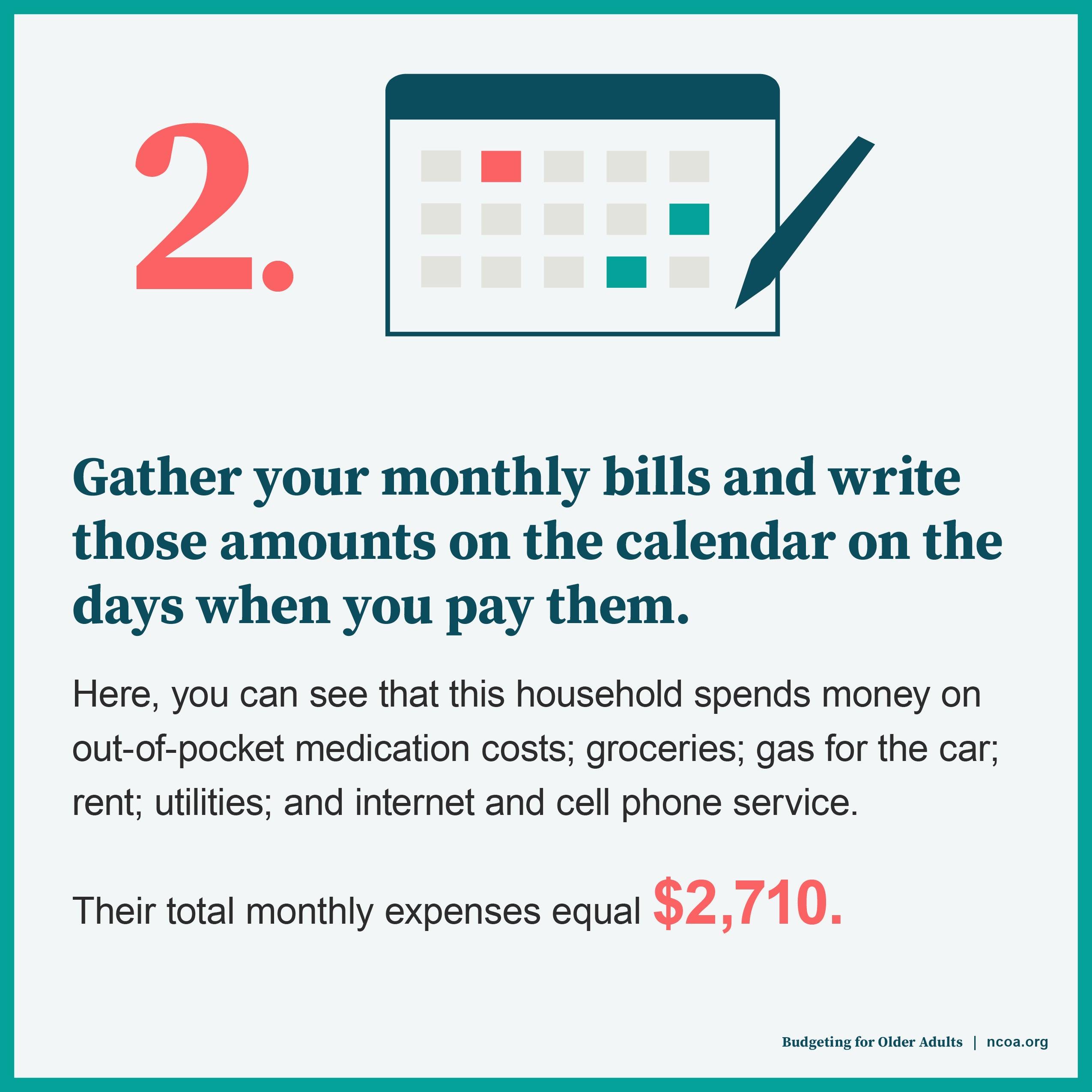

- Your expenses: Gather up your regular monthly bills and when they’re due. These include your mortgage or rent; your health insurance and medications; food; utilities; car payment or other transportation costs; and other fixed expenses.

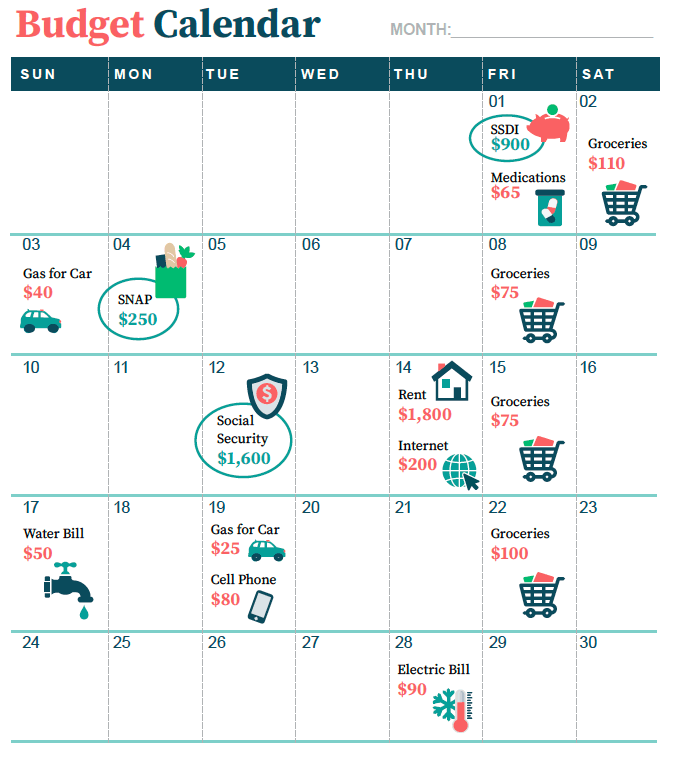

Now, write each of these things on your calendar (see NCOA's example below for a budget calendar you can download).

Step 1: Mark down and circle your payday(s).

Step 2: Add what you spend on your bills and when.

Step 3: Tally up. Subtract your total expenses from your total income to see where you stand.

You can use any extra money for discretionary spending such as entertainment, birthday gifts, and clothing, for instance. Of course, it’s always a great idea to save some of it, too, so you can better absorb those unexpected price changes.

By giving you a sense of control over your finances, a budget calendar can reduce your money-related stress and help you stretch your food dollars.

Try creating yours today with NCOA's blank calendar (link to download at home).

What if I need help paying for groceries? Can NCOA help?

Yes. Start by exploring our SNAP for Older Adults resource library, where you’ll discover a variety of helpful articles including the income limits for SNAP, how to apply for SNAP assistance, where you can use your SNAP benefits, and much more.

You can also learn about the Senior Food Box program, how to get senior farmers’ market vouchers, and where to find emergency food assistance near you.

When you’re ready, you can use NCOA’s confidential digitial tool BenefitsCheckUp—NCOA's confidential digital tool— to see if you qualify for SNAP or other food assistance programs that may be available in your area.

Sources

1. Hayden Stewart, et al. Food Price Outlook – Summary Findings. USDA Economic Research Service (ERS). April 25, 2025. Found on the internet at https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings

2. Abha Bhattarai. Fewer hot showers, less meat: How retirees on fixed incomes are dealing with inflation. The Washington Post. March 21, 2022. Found on the internet at https://www.washingtonpost.com/business/2022/03/21/elderly-inflation-fixed-income/

3. UMass Boston’s Elder Index. Found on the internet at https://elderindex.org/elder-index (Data in the example accessed on May 20, 2025).

4. Social Security Administration, “Effect of COLA on Average Social Security Benefits.” Found on the internet at https://www.ssa.gov/oact/cola/colaeffect.html