Who receives Medicare? Generally speaking, you are eligible for Medicare coverage when you turn 65 or have met certain other eligibility criteria.

Many people may wonder, is it mandatory to go on Medicare when you turn 65? The answer is no. If you’re 65 or older and have private health insurance through your active employer or your spouse’s active employer, you don’t have to enroll in Medicare until either the employment or the coverage ends. There is a caveat, however. You cannot delay Medicare enrollment if your or your spouse’s employer-sponsored coverage comes from COBRA or retiree benefits.

Can you enroll in Medicare at any time?

There are several times to enroll in Medicare, and each of those times has its own rules around applying and when coverage will begin. Understanding when to enroll is an important part of avoiding coverage gaps and Medicare late enrollment penalties. Below, we take a look at the various enrollment periods for Medicare.

Initial Enrollment Period

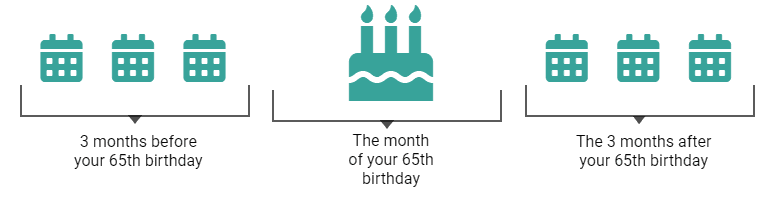

The Initial Enrollment Period (IEP) is the first time to sign up for Medicare and join Parts A, B, C, and D. It happens:

- Three months before your 65th birthday

- During your birthday month, and

- Three months after your 65th birthday

When is my 7-Month Initial Enrollment period?

Coverage will start no sooner than the month of your 65th birthday month, but you can enroll three months before your birthday.

Example: If your birthday is in July, your Initial Enrollment Period begins April 1 and ends Oct. 31.

If you miss your enrollment period, you will have another chance to enroll. But waiting could result in late penalties and a period without health coverage. Learn more about penalties for late enrollment.

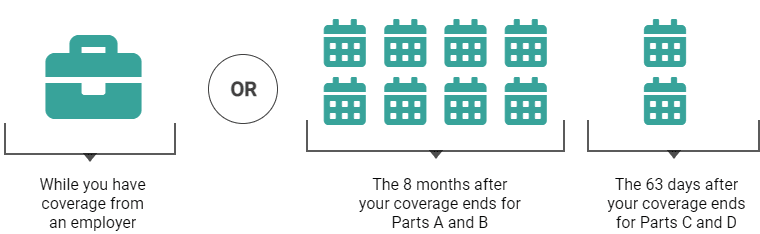

Special Enrollment Period

There are Special Enrollment Periods (SEPs) that apply when you're eligible for delayed enrollment in Medicare Parts A, B, C, and D. These SEPs are only available for certain circumstances. Learn more about Medicare Special Enrollment Periods.

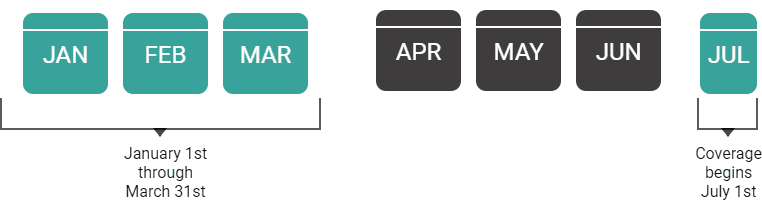

General Enrollment Period

If you miss the Initial Enrollment Period or Special Enrollment Period, there is another chance to enroll.

Enrollment in Medicare Parts A and B can also happen between Jan. 1 and March 31 each year. Medicare coverage would begin on July 1 of the same year. Coverage gaps and late enrollment penalties can apply.

It is important to note that if Part A is needed during this time, enrollment in Part B is required as well.

When is the General Enrollment period?

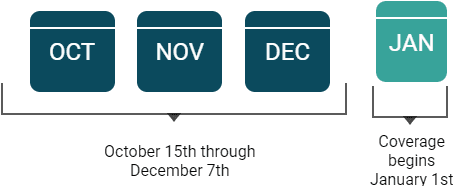

Open Enrollment Period

The Open Enrollment Period—sometimes called the Annual Election Period or Annual Coordinated Enrollment Period—runs each year from October 15 to December 7. During this time:

- Anyone with original Medicare (Parts A & B) can switch to a Part C (Medicare Advantage) plan.

- Anyone with Medicare Part C/Medicare Advantage can switch back to original Medicare (Parts A & B) and enroll in a Part D plan.

- Anyone who has original Medicare (Parts A or B) can join, drop, or switch a Part D prescription drug plan.

- Anyone with Medicare Part C/Medicare Advantage can switch to a new Part C plan.

Coverage will start on Jan. 1 of the following year.

When is the Open Enrollment period?

Annual Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period provides additional opportunities to change Medicare Advantage plans outside of the Annual Election Period (Oct. 15 – Dec. 7). Learn more about the Medicare Advantage Open Enrollment Period.

When is the Medicare Advantage Open Enrollment period?

Medigap Open Enrollment Period

It’s recommended you buy a Medigap policy during the six-month Medigap Open Enrollment Period. That's because during this time, any Medigap policy sold in state can be purchased at the lowest available cost and you cannot be denied based on pre-existing conditions. This period automatically starts the first month you're enrolled in Medicare Part B and you're 65 or older. Learn more about Medigap.

Need help choosing the right Medicare coverage?

Reach out to your local State Health Insurance Assistance Program (SHIP) for guidance. SHIPs provide free, unbiased counseling to Medicare beneficiaries and their families. A SHIP counselor can help you assess your needs, understand your coverage options, and make informed enrollment choices.

Find your SHIP by visiting the program website or by calling 1-877-839-2675.