Building a Bridge to Avoid the “Medicare Cliff” That Harms Older Adults

3 min read

Many of us look forward to turning age 65, not only because retirement is often right around the corner, but also because that's when most people become eligible for health insurance coverage through Medicare. But for low-income Americans under age 65 who rely on the Medicaid program for either health insurance coverage or for program subsidies to assure health care is affordable, turning age 65 can present a significant risk.

This is because eligibility criteria for the Medicaid program differ for people above and below age 65 and become more stringent for people age 65 and over. For example, in most states, individuals who fall below 138% of the federal poverty level (FPL) and have low assets are eligible for Medicaid before age 65, but this threshold often falls to 100% or below after age 65.

What is the "Medicare Cliff"?

The loss of supplemental Medicaid coverage after age 65 means such individuals face significantly more coverage gaps and out-of-pocket expenses in the form of premiums and co-payments for health care under Medicare. This phenomenon is known as the “Medicare Cliff”.

About 280,000 older adults hit the "Medicare Cliff" each year, losing their Medicaid coverage and previous help they had affording health insurance premiums and related health care costs. With health care costs being one of the leading causes of bankruptcy in later life, Medicaid plays an important role in providing access to health care for financially vulnerable individuals. Still, questions remain about whether the Medicaid program is reaching enough of these vulnerable individuals and what happens when it doesn’t.

Falling off the “Medicare Cliff” means poor health outcomes

Recent research shows that older adults who experience the Medicare Cliff or are close to meeting Medicaid eligibility criteria (but fall short of qualifying because of slightly higher income or assets) are very similar in demographic, health, and financial profiles to those who continue to be enrolled in Medicaid or become eligible for Medicaid at age 65. In other words, their characteristics closely match those of individuals who are already benefiting from the program. The question that has not been adequately answered until now is how these similarly vulnerable individuals are faring without Medicaid coverage compared to those who remain enrolled in the program as a supplemental coverage after age 65.

We conducted a longitudinal analysis of older adults tracked in the 2012 through 2020 waves of the nationally representative Health and Retirement Study (HRS) to compare key health trends during this time period to explore this question. Our intention was to identify those individuals who reported utilizing Medicaid coverage before age 65 and then lost it because their incomes were below 138% of the FPL once they reached age 65.

Because health insurance coverage is tracked in the HRS, we could determine who was no longer utilizing the program. In line with what has been observed in prior studies,1,2 groups who experienced the Medicare Cliff (and who fell below 138% FPL) were substantially alike in characteristic profiles to those who remained enrolled in the Medicaid program after age 65.

However, despite being so similar, these groups were markedly different in their health trends over time. For example, over the eight-year period:

- There was a 15% decline in the proportion of people reporting that their health was fair or poor. In contrast, those in the Medicare Cliff group showed a 13% increase in reporting fair or poor health. This is consistent with the fact that they also show the greatest increase in the number of chronic conditions over the period when compared to those continuously on Medicaid.

- People who did not experience the Medicare Cliff and maintained continuous Medicaid coverage after age 65 also showed a notable 9% decrease in depression over time, compared to a 2% increase for the Medicare Cliff group.

- Being enrolled in Medicaid was significantly associated with 23% lower odds of depression by 2020 compared to those not utilizing Medicaid. Those in the Medicare Cliff group had 17% higher odds of depression by 2020.

These findings indicate that Medicaid is playing an important role in improving health among those who are enrolled in the program compared to those who are similarly vulnerable but unable to qualify once they reach age 65.

It costs beneficiaries a lot to fall off the Medicare Cliff

For individuals receiving Medicaid after age 65, the financial benefits are meaningful in terms of reducing out-of-pocket medical costs. On average, such costs for Medicaid beneficiaries decreased by $2,223 over the study period in contrast to increases of about $1,500 for individuals who lost their coverage when they turned 65.

Results were similar even when controlling for sociodemographic characteristics. Being enrolled in Medicaid over the study period was significantly associated with a $2,060 decrease in out-of-pocket medical costs by 2020 compared to those who were not able to utilize Medicaid.

In contrast, experiencing the Medicare Cliff was significantly associated with a $1,200 increase in such costs. It is not surprising that those experiencing the Medicare Cliff also saw a greater financial resource decline over time; they were less likely to retire and more likely to re-enter the workforce compared to those accessing Medicaid after age 65; it may be the case that they have to go back to work to make ends meet.

What it would mean to find ways to eliminate the Medicare Cliff

These findings highlight that many older adults who share similar characteristic profiles to those enrolled in the Medicaid program after age 65 are at both health and financial disadvantages when they are unable to access the program because of closely missing eligibility criteria. Expanding Medicaid coverage to include more of these individuals could greatly improve well-being and reduce mortality rates. In fact, research has shown that prior Medicaid expansion under the Affordable Care Act prevented nearly 20,000 premature deaths among older adults. Put simply, eliminating the Medicare Cliff can both improve health outcomes as well as reduce financial liabilities.

How we eliminate the Medicare Cliff

As policymakers strive to improve access to affordable health care for vulnerable older adults, it is important to consider adjustments to eligibility criteria as a way of widening the social safety net that Medicaid provides. For starters, there are serious considerations to be made about continuing to base financial eligibility for Medicaid on the outdated FPL measure.

It is time to begin reexamining the current eligibility criteria and understanding the implications of adjusting thresholds to better account for the realities of the increases in basic cost of living.

As a first step, income limits could be raised to 138% of the FPL, and Medicaid resource limits could be eliminated after age 65 so that there are no coverage discontinuities in Medicaid eligibility above and below age 65.

At the same time, one of the ways to improve the affordability of Medicare premiums, deductibles, copayments, and coinsurance for low income older adults is by facilitating access to Medicare Savings Programs (MSP). These plans are federally funded programs administered by each individual state. Enrollment in MSPs have increased significantly, according to the Medicaid and CHIP Payment and Access Commission (MACPAC), and the majority of dually eligible beneficiaries are enrolled in an MSP.

And there is still opportunity to enhance existing outreach, education, and the enrollment process for these programs to further close the gap between eligibility and enrollment. Recognizing this, CMS has implemented a recent rule that simplifies processes for eligible individuals to enroll and retain eligibility in the Medicare Savings Programs (MSPs) and it also reduces the complexity in the application and reenrollment process.

Finally, expanding eligibility for such programs among low income groups by increasing income limits and removing asset limits would have a major impact on program beneficiaries. All such approaches are designed to avoid the personal and societal impacts that occur when access to care and health outcomes are compromised for those facing the Medicare Cliff and for other low-income older adults.

This analysis builds off of research published earlier this year that explains more about the Medicare Cliff, who it impacts, and policy experts’ recommendations to eliminate the Cliff through different policy interventions.

Download the 2024 report:

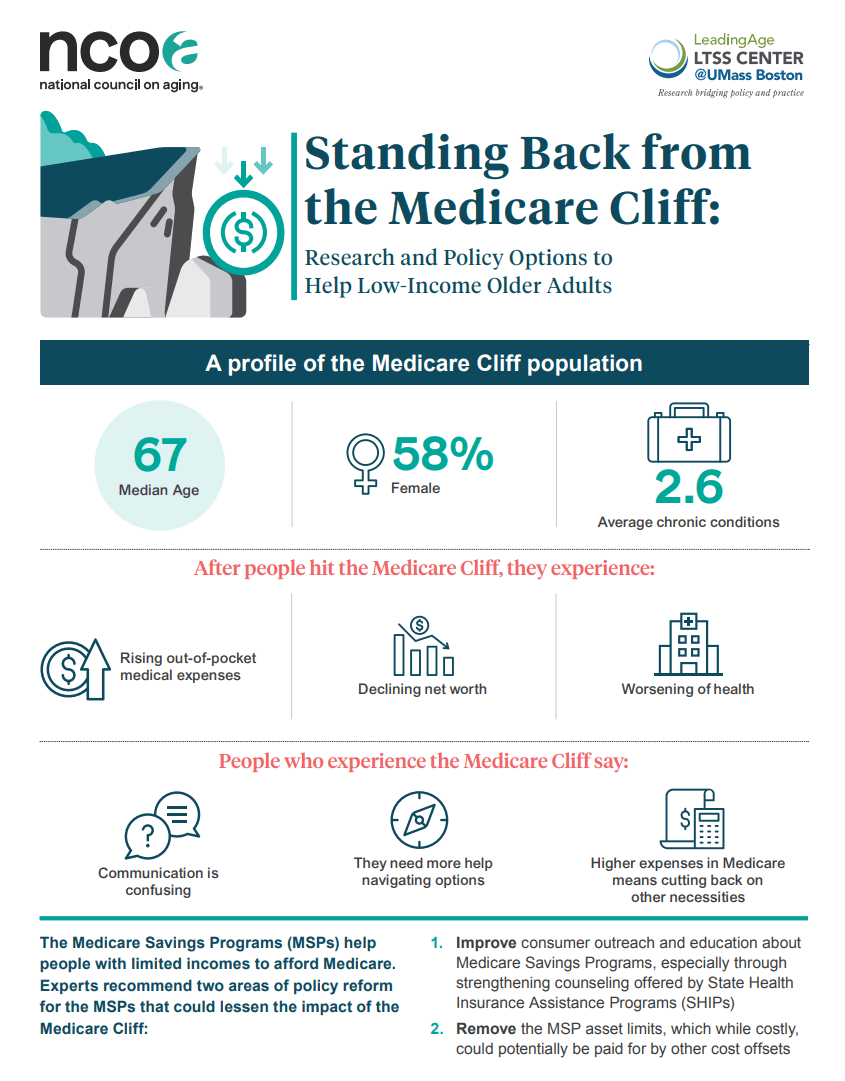

Download the 2024 report infographic:

Sources

1. Eric T. Roberts, PhD, et al. Medicare Coverage 'Cliff' Increases Expenses And Decreases Care For Near-Poor Medicare Beneficiaries. Health Affairs. April 2021. Found on the internet at https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8068502/

2. Marc A. Cohen, PhD, and Jane Tavares, PhD. How Medicaid Financial Eligibility Rules Exclude Financially and Medically Vulnerable Older Adults. Journal of Aging & Social Policy. March 2023. Found on the internet at https://www.tandfonline.com/doi/full/10.1080/08959420.2023.2195784