Women and Retirement: When They Retire, How They Plan, and Where Help Is Needed

8 min read

Women face a series of obstacles that make achieving financial security in retirement more challenging. They make less money than men; they often work part time, take time away from work to care for children and aging parents, save less money, work in fields with fewer employer-sponsored retirement benefits, have more chronic diseases with their related costs, and feel less comfortable discussing finances. All these factors contribute to and can exacerbate women’s struggle as they prepare for and live in retirement.

In an effort to better understand how women prepare for and live in retirement, NCOA conducted a survey of Americans age 50 and older on behalf of Nationwide. While the survey primiarly focused on women, men also were able to complete the survey. The findings from this study will help determine the types of assistance, products, and services women may need as they approach and begin retirement.

Below are a few key findings from NCOA's March 2022 Women Living in and Preparing for Retirement:

When are women retiring?

Women, on average, reported retiring at age 64. Women reported retiring most often between the ages of 60 and 69.

- 3% retired before age 50

- 15% retired between 50-59

- 35% between age 60-64

- 36% between age 65-69

- 10% retired at age 70 or older

What are women primarily concerned about when it comes to finances and retiring?

Among other concerns in the report, key highlights include:

- Nearly nine in 10 (89%) report being very or somewhat concerned with the increasing cost of health care.

- Three-quarters (75%) are very or somewhat concerned about being able to afford long-term care for themselves or a partner/spouse.

- More than seven in 10 (71%) of retired women are very or somewhat concerned about caregiving needs they may have, which is significantly more than the concerns reported by retired men (59%).

- More than half (56%) of retired women are concerned that they will not have enough money to live comfortably in retirement. (download infographic to share)

Where would women like help when it comes to retirement?

When asked in which areas they would like help:

- Two in five (41%) retired women said they would like help planning for their own care as they age.

- A third (33%) said they would like help planning how to age in place, significantly more so than retired men (25%).

Retired women also would like help with:

- Accessing public benefits (26%)

- Choosing the right health care plan (21%)

- Learning how to minimize taxes with income distribution from retirement plans (18%)

- Learning how to continue to grow their income during retirement (18%)

- Finding options for earning income during retirement (17%)

How do women plan for retirement?

Respondents were asked about steps they took to plan for retirement, among others - a few of the key highlights were:

- Over half (52%) said they tried to reduce their expenses

- Nearly half (48%) report participating in an employer-sponsored retirement savings plan, such as a 401(k) or 403(b)

- Forty-five percent (45%) paid off debt

- Over a quarter (26%) downsized their home

What happens when a woman takes on the role of caregiver? How does that impact their retirement?

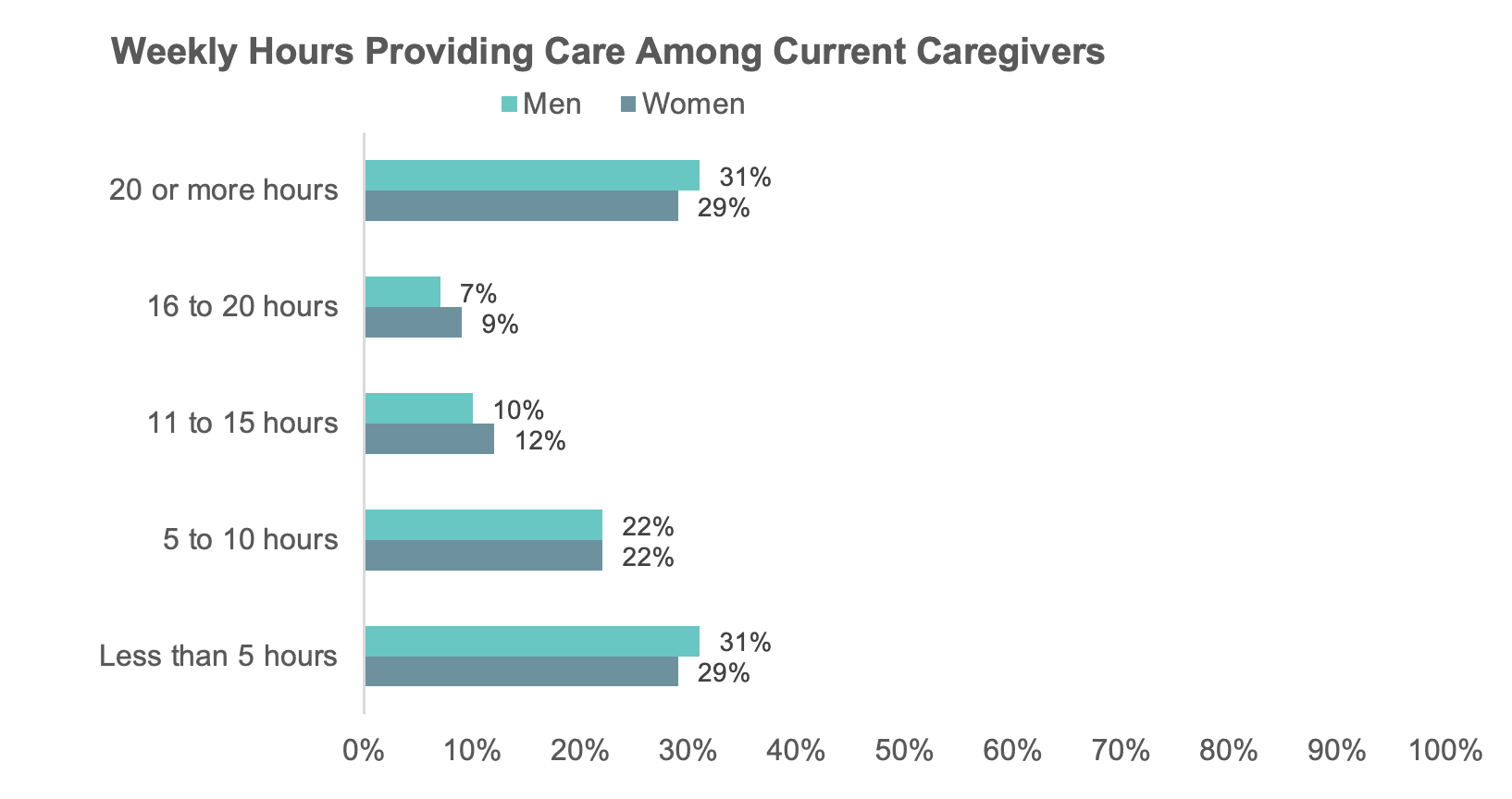

While a quarter of older women are currently providing care, many more have been involved in providing care over the course of their life. Neary six in 10 (58%) older women have provided care for family members or friends in their lifetime, compared with 41% of men.

When it comes to the finances, nearly 7 in 10 (69%) older women who are currently providing care say that it is a strain on their finances, compared with 58% of male caregivers. Around a quarter (23%) of older female caregivers say that providing care is very much or considerably a financial strain.

Current female caregivers indicate they have experienced the following as a result of providing care:

- 47% used savings to pay for things needed to care for their family member or friend

- 33% took on more debt such as credit cards, loans, and lines of credit

- 27% left their bills unpaid or paid them late

- 26% put off when they planned to retire or decided to never retire (significantly more than male caregivers, 16%)

- 22% have been unable to afford their own basic expenses like food and medicine

- 16% borrowed money from family or friends

NCOA's methodology

The survey was programmed through Qualtrics and sent to older adults and caregivers who received NCOA’s consumer newsletter and those who opted to provide their email address when completing a screening on NCOA’s BenefitsCheckUp® or Falls Free CheckUp. Survey respondents could be entered into a drawing for one of two $100 gift cards. Data collection occurred between August 23 and September 13, 2021.

As noted above, the focus of the survey was on women, however, men were included in the sample to examine gender differences. Of 1,490 respondents, 1,125 identified as female and 365 identified as male. The response rate was 3%, which is comparable to previous surveys with our email lists.

Profile of survey respondents

- More than three in five respondents were between the ages of 65 and 74.

- Most respondents indicated they were white.

- Male respondents were significantly more likely to be married than female respondents (60% vs. 37%, respectively).

- A quarter of women and one in five men report gross household incomes of less than $2,000 per month, which is below 200% of the Federal Poverty Level for a one-person household.

- A third (34%) of the female respondents and 38% of male respondents reported working full-time, part-time or were unemployed, but not retired.

- Three percent of female respondents considered themselves homemakers.

- Sixty-three percent of female respondents and 62% of male respondents considered themselves retired.

Download the PDF to read the full paper.